12:00 PM

SEF Consolidation Likely as Volumes Slowly Increase

Compression trades boost Tradeweb’s volumes

Tradeweb saw its volume spike on the strength of compression trades, a style of trading that allows buy side firms to reduce their risk and margin costs at the clearinghouse.

Though the compression-style trades were relatively slow to take off, volume of this type of trade has recently skyrocketed due to newly “made-available-to-trade,” or MAT, swaps and packages moving onto SEFs, wrote Tradeweb’s spokesman in a media alert.

Since the first week of June, compression trading volume on Tradeweb has increased more than 140%.

Tradeweb has already seen more than $40 billion traded through the use of the compression tool in July 2014 alone and over $90 billon since launch. Tradeweb has 35 different clients that have used the tool ranging from asset managers to hedge funds. “The compression platform is integrated into our overall derivatives solutions,” said Chris Amen, Tradeweb’s managing director overseeing US institutional rates markets.

Chris Ferreri, ICAP North America

Chris Ferreri, ICAP North America

Compression is a form of “balance sheet optimization,” explainsAmen. “It allows clients to load trades they have, seamlessly get quotes on those trades so they can net them out and so they can reduce the margin they have at clearing houses,” he explains.

Two weeks ago, Tradeweb reported total activity of $19 billion and more or less $7 billion was compressed. “Some of these numbers can get quite large,” says Tod Skarecky, Senior Vice President Americas, Clarus Financial Technology in Chicago, who tracks the SEF volumes.

TrueEx began marketing compression trades to the buy side three years ago. Tradeweb announced that it completed its first compression trade in November 2013, while TrueEx announced its first compression trade in December. Other SEFs may pick up on compression trades, too. Bloomberg is due to release compression trade capabilities in Q3 or Q4.

Industry watchers point out that Tradeweb, a bond trading and derivatives network, is majority owned by Thomson Reuters, but has the support of its dealer which are minority investors including Goldman Sachs, JPMorgan, Morgan Stanley, Citigroup, Morgan Stanley, Citigroup, Bank of America, Credit Suisse Group AG, Deutsche Bank AG, UBS AG, Royal Bank of Scotland Group and Barclays Plc.

According to a recent Greenwich Research report, “Rise of the Flow Monsters,” the top five dealers commend over 65% of the market share in interest rate derivatives. The top 5 dealers in 2014 are Goldman Sachs, Deutsche Bank, Citi, J.P. Morgan, and Barclays.

D2D: Separate worlds for now

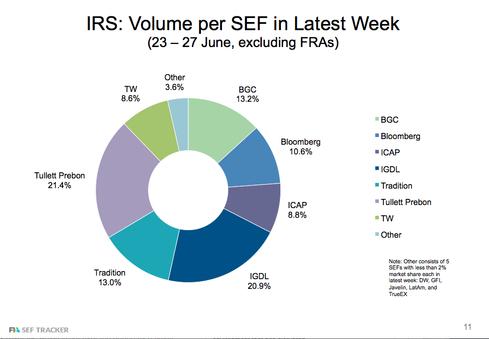

Meanwhile, interdealer brokers have been making the transition from voice trading to SEFs. ICAP has 40% of the dealer-to-dealer (D2D) business, and is running about 28% of SEF market share overall. ICAP executed about $100 billion in July and about $40 billion was electronically traded on iSwap. ICAP also launched IGDL, a UK-based SEF as a second platform in London.

On the strength of interest rate swaps and in non-deliverable foreign exchange forwards, ICAP is running about 28% share of the SEF market overall based on notional volume, according to FIA SEF Tracker.

“We’re working very hard to promote the electronic order book and to get the market to use the order book,” said Chris Ferreri, managing director, ICAP North America. ICAP is also integrating its iSwap central limit order book (CLOB) with is voice-based vRFQ 2.0 execution services by publishing quotes on Reuters 19901.

Going forward the most critical factor will be liquidity. Liquidity is also bifurcated between the D2C and D2D markets. “You have to look at the IDB platforms and the traditional customer to dealer are viewed as separate markets,” said McPartland. “Even though the regulators view them all as the same, the market participants continue to view them as they always have,” he said.

Boston Consulting Group’s Rhode adds, the IDB model has dual challenges of transitioning from the voice based to electronic SEF, and also opening up their liquidity pool to buy side firms,” said Rhode.

“We will start to see a reduction in the number of players,” Rhode predicts. Already, the market has begun to see some mergers & acquisition activity with CME Group buying the Trayport energy platform and Fenics software analytics from GFI Group in a deal valued at $655 million. CME will then sell GFI’s wholesale brokerage and clearing businesses to a private consortium headed by the firm’s management. “Certainly the advent of SEFs opens the door to different types of firms merging or acquiring,” said Rhode.