09:00 AM

Corvil Launches Streaming Analytics Platform to Mitigate IT Risk in Electronic Trading

Analytic plugins

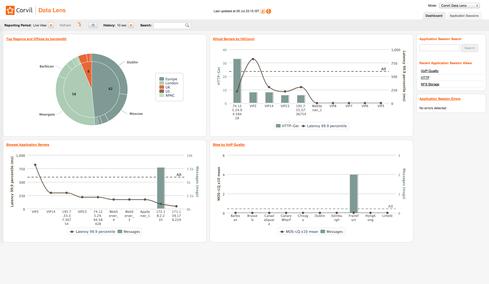

In addition, Corvil has more than 500 analytic plugins related to all of the market data and trading protocols and all of the enterprise IT operations protocols. When the network session is discovered, it starts measuring various metrics. For example, with volumes it would measure not just fill rates and message rates but any unusual anomalies as well. “All of this aimed at doing automated discovery and instant visibility of any activity is happening in the trading system,” says Byrne.

Some of the recent IT incidents such as Knight Capital occurred because a piece of code update didn’t occur on a virtual machine that was inactive. Corvil’s Giga product would have seen the code on the virtual machine, he contends.

Global Data Search allows users to search all indexed fields to product instant answers. “Every metric and field we calculate, we index and make it globally searchable.” This means if someone sees something related to a customer order ID, or the SEC contacts the firm, they can search to show them the complete lifecycle of the order. “Any place that Corvil has seen that specific transaction or lifecycle it will call it up.” This gives unskilled people the ability to go in and query any event and see the lifecycle of that event.

Analytics streams

Firms can also publish analytics streams or feeds -- just as they have market data feed -- to big data and business intelligence (BI) systems. For example someone can request a feed for all customer orders that have a latency of, say, one millisecond or customer order types with a certain value.

Corvil is also providing analytic adapters so that firms can stream that data out and put it into a database like Mondo DB or kdb and put it into a big data or Hadoop environment, or stream it into the Amazon cloud.

The new product has been in beta tests with a leading customer for the past three months and is expected to be rolled out across exchanges and global banks over the coming months. The Giga release will be offered for free as a software upgrade to standing Corvil deployments.

At big exchanges, many IT operations people leverage this data, and Corvil has two major clients that are using the data to offer real-time reporting to their clients. "We leverage Corvil, not only for performance monitoring within our own infrastructure, but also for the risk management solutions, which we provide to the trading community, and we look forward to using Corvil's new Streaming Analytics platform," commented Stacie Swanstrom, SVP and head of Access Services, a division of Nasdaq OMX's Global Trading and Markets business line, in a statement.

Previously, it was not feasible to take petabytes of data and stream it through the network and push it through big-data technology because it couldn’t update in real time, says Bryne. “The problem with all of this is to see and react.”

Now the idea with Corvil’s platform is to analyze those petabytes of data in motion and on the fly and extract the subset of data that you need to store and analyze for further business intelligence, risk analytics, and compliance reporting. Customers are having this problem in anticipation of the next wave of financial regulatory requirements.

Inputs to kill-switches

One stock exchange customer of Corvil is using the real-time alerts as sensory input to kill-switches for risk mitigation. “That would be able to identify these unusual risk anomalies. We would provide an alert to a risk system that would then analyze risk further and then issue an alert to a kill-switch.”

However, people are not yet comfortable with implementing fully automated kill-switch paradigms, because they have to trust the signaling information. “What we’re trying to do is provide a level of confidence and trust.”

Ultimately, Corvil is looking to make the modern trading infrastructure safer. At a human level, you can’t afford to be waiting 20 minutes to detect an IT risk. “You can have yourself traded out of business in 20 to 30 minutes,” notes Byrne, referring to the case of Knight Capital that sought a rescue from Getco in 2012. As people become more comfortable with the automated paradigms, they can take 30 minutes and reduce it to a few seconds, and diffuse the problem, he tells us.

“The machine world happens at a level of granularity and speed. We can use these technologies and tools to inform that in a much better way.

“I am hoping that this type of technology ushers in a new level of transparency and the ability to safeguard these new kinds of electronic trading infrastructures.”

Ivy is Editor-at-Large for Advanced Trading and Wall Street & Technology. Ivy is responsible for writing in-depth feature articles, daily blogs and news articles with a focus on automated trading in the capital markets. As an industry expert, Ivy has reported on a myriad ... View Full Bio