08:00 AM

Pressures on Bank IT in the Age of Cloud

It may safely be said that the first wave of cloud computing adoption, or Cloud 1.0, is largely a mainstream endeavor in financial services and no longer an esoteric adventure only for brave innovators. A range of institutions are either deploying or testing cloud-based solutions that span the full range of cloud delivery models -- IaaS (infrastructure-as-a-service), PaaS (platform-as-a-service), SaaS (software-as-a-service), etc .

As Brett King notes in his important work on Bank 3.0, this is the age of the hyper-connected consumer. Customers are expecting to be able to bank from anywhere, be it from a mobile device or via the Internet from their personal computers.

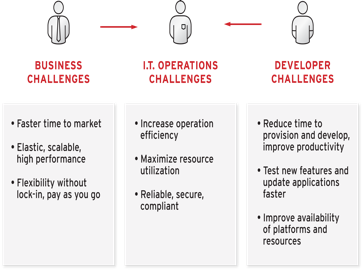

Thus there is significant pressure on banking infrastructures in three major ways:

- To be able to adapt to this new way of doing things and to be able to offer multiple channels and avenues for such consumers to come in

- To offer agile applications that can detect customer preferences and provide value-added services on the fly -- services that not only provide a better experience but also help in building a long-term customer relationship

- To be able to help the business prototype, test, refine, and rapidly develop new business capabilities

The core nature of corporate IT is thus changing from an agency dedicated to keeping the trains running on time to one that is focused on innovative approaches like being able to offer IT as a service (much like a utility) as discussed above. It is a commonplace that large banks are increasingly turning into software development organizations.

The example of web-based startups forging ahead of established players in areas like mobile payments is a result of the former's ability to quickly develop, host, and scale applications in a cloud environment. The benefits of rapid application and business capability development have largely been missing in banking IT's private application platforms in the enterprise datacenter.

Six key technology paradigms that have to be considered by industry players in 2014 include:

- Business process and workflow automation, not only to remove the dependence on hardwired and legacy processes, but also to understand and refine the current state of affairs

- Complex event processing capabilities to be able to detect and react to big-data streams like social media feeds for payment data -- the applicability of these technologies in areas like fraud detection has been well documented

- In the data space, data grids and data virtualization technology that not only does faster analytics, but also is able to provide regulatory and compliance-related stakeholders with 360 degree views

- Open integration that focuses on bringing together disparate capabilities across the enterprise

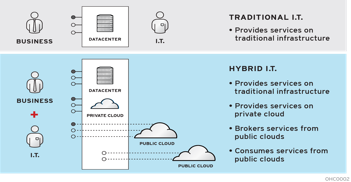

- Cloud computing as an enabler for infrastructure agility and application mobility -- being able to leverage a mix of private and public cloud capabilities in a secure manner

- Platform-as-a-service to deliver faster time to market and change to critical applications and business capabilities around X-as-a-service

A final word of advice in this age of cost cutting is for executives to look to leverage open-source where possible across the above areas. The world's leading web properties and Fortune 1000 institutions use a variety of open-source technologies. Robust and well supported offerings are now available across the spectrum, and these can help cut IT budgets by billions of dollars.

As Chief Architect of Red Hat's Financial Services Vertical, Vamsi Chemitiganti is responsible for driving Red Hat's technology vision from a client standpoint. The breadth of these areas range from Platform, Middleware, Storage to Big Data and Cloud (IaaS and PaaS). The ... View Full Bio