05:35 PM

Tracking the True Technology Cost of Compliance, Regulation & Risk

A bad formula

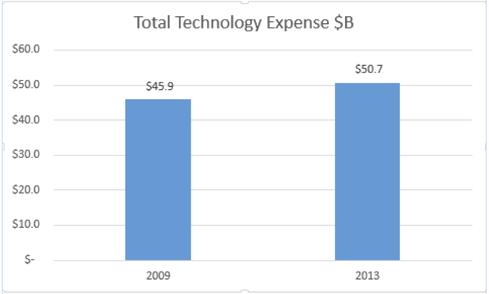

A combination of increasing expenses and decreasing revenue makes for bad business. But why should technology expenses be increasing as revenue declines? Moreover, why are overall expenses increasing 60% faster than technology expenses?

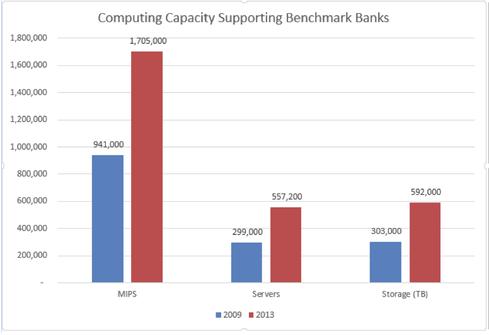

Before attempting to answer the question, let's go under the IT covers and see what is happening in the area of infrastructure. The following chart represents the profile of installed MIPS, total server instances, and distributed storage across banks that we benchmark.

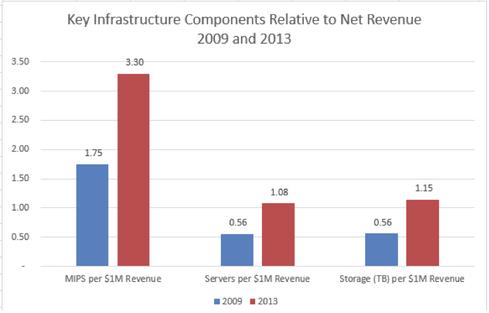

Simply put, while net revenue declined 4.1%, in absolute terms, total MIPS grew 81.2%, server instances grew 86.4%, and storage grew 95.4%. And in relative terms, computing intensity (capacity relative to revenue) also grew tremendously, as you can see in the following chart.

This growth infrastructure can be attributed to the evolution and introduction of business products, emerging technologies going mainstream (e.g. mobility, big data), and regulation/compliance and risk management. Fairly good data is available on the first two drivers (business product evolution/introduction and emerging technologies going mainstream). By the process of elimination, we can estimate the contribution of the highly elusive third driver, regulation/compliance and risk management.

Analysis of cost drivers indicates that at least 75% of the growth of total technology expenses is a result of the additional applications and related computing cycles and storage needed for legislative mandates (Dodd-Frank, Basel II/III), AML, KYC, and security in general. So, in addition to the known cost of regulation, risk, and compliance (about $2.84 billion of the $50.7 billion total technology expenses for the Bank of Banks), there is $924 million that has not been charted at all. This effectively moves the percentage of spending on risk and compliance even higher.

Taking the long view, the cost of compliance may have added $4 billion to the Bank of Banks' costs from a technology perspective alone from 2009 to 2013.

Cost of compliance

At the same time, the infrastructure demand increase is another cost of compliance. This increased demand is great enough to counteract the forces of Moore's Law and drive costs up.

Finally, the purpose of this Bank of Banks exercise is to provide a view of some of the IT cost drivers in the financial services sector -- a sector that is a major component of the world's GDP.

Historically, the major drivers of IT costs for financial services have been related to the fact that financial services products have become more like technology products, and that banking is introducing higher and higher levels of automation both for internal processes and at the customer interface. Today, a new and significant cost driver has emerged: the cost of regulation, compliance, and risk. Organizations that strive to become the masters of their technology economics, instead of being victims, need to understand and manage all these new cost drivers.

Dr. Howard A. Rubin is a Professor Emeritus of Computer Science at Hunter College of the City University of New York, a MIT CISR Research Affiliate, a Gartner Senior Advisor, and a former Nolan Norton Research Fellow. He is the founder and CEO of Rubin Worldwide. Dr. Rubin is ... View Full Bio